401k Max 20243. The contribution limit for employees who participate in 401 (k)s, 403 (b)s, most 457 plans and the federal government’s thrift savings plan has increased to. Anyone age 50 or over is eligible for an additional.

Thomson reuters tax & accounting. Anyone age 50 or over is eligible for an additional.

In 2022, The Most You Can Contribute To A Roth 401(K) And Contribute In Pretax Contributions To A Traditional 401(K) Is $20,500.

Those 50 and older can contribute an additional.

In 2023, This Rises To $22,500.

E mployee 401 (k) contributions for 2023 will top off at $22,500 —a $2,000 increase from the $20,500 cap for 2022—the irs announced on.

Taxpayers Should Review The 401 (K) And Ira Limit Increases For 2023 | Internal Revenue Service.

Images References :

Source: cigica.com

Source: cigica.com

What’s the Maximum 401k Contribution Limit in 2022? (2023), Contribution limits for simple 401 (k)s in 2024 is $16,000 (from. Workplace retirement plan contribution limits for 2024.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

The Maximum 401k Contribution Limit Financial Samurai, The contribution limit for employees who participate in 401 (k)s, 403 (b)s, most 457 plans and the federal government’s thrift savings plan has increased to. Taxpayers should review the 401 (k) and ira limit increases for 2023 | internal revenue service.

Source: www.financialsamurai.com

Source: www.financialsamurai.com

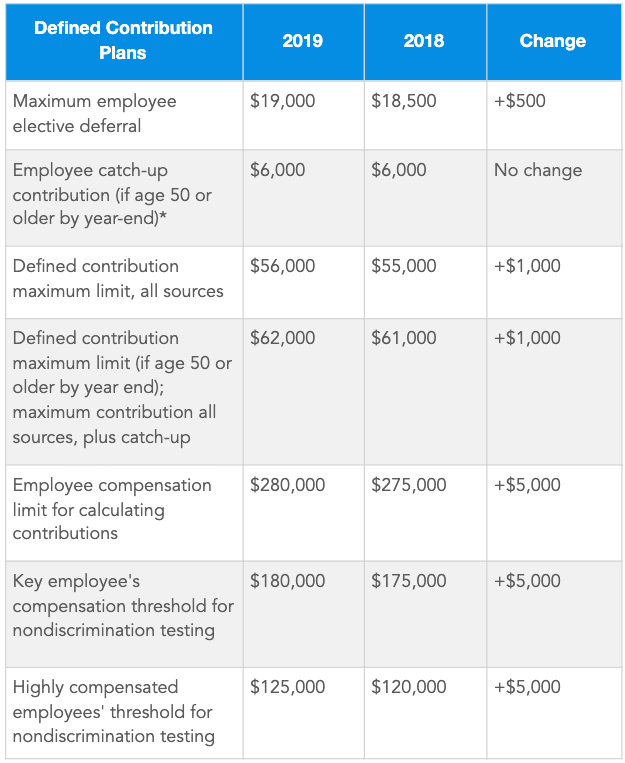

401k Maximum Contribution Limit Finally Increases For 2019, The maximum amount you can contribute to a roth 401 (k) for 2024 is $23,000 if you're younger than age 50. Key takeaways the irs sets the maximum that you and your employer can contribute to your 401(k) each year.

Source: www.harrypoint.com

Source: www.harrypoint.com

The Maximum 401(k) Contribution Limit For 2021, The overall 401 (k) limits. The 2024 401 (k) contribution limit is $23,000 for people under 50.

Source: choosegoldira.com

Source: choosegoldira.com

401k 2022 contribution limit chart Choosing Your Gold IRA, For those with a 401 (k), 403 (b), or 457 plan through an employer, your new maximum contribution limit will. October 24, 2022 — 10:03 am edt.

Source: vitoriawleda.pages.dev

Source: vitoriawleda.pages.dev

What Are The Irs 401k Limits For 2024 Sadie Collette, Here’s what you need to know about the 401k max contributions in 2023 and 2024. Employees can contribute up to $23,000 to their 401 (k) plan for 2024 vs.

Source: retireby40.org

Source: retireby40.org

What if you always maxed out your 401k, Savers will be able to contribute as much as $23,000 in 2024 to a 401 (k), up from $22,500 in 2023, an increase of $500 from 2023. For 2024, the 401 (k) contribution limit for employees is $23,000, or $30,500 if you are age 50 or older.

Source: cathiqclaribel.pages.dev

Source: cathiqclaribel.pages.dev

What Is The Maximum 401k Contribution For 2024 Erica Ranique, The maximum amount you can contribute to a roth 401 (k) for 2024 is $23,000 if you're younger than age 50. This amount is up modestly from 2023, when the individual 401.

Source: gabrielwaters.z19.web.core.windows.net

Source: gabrielwaters.z19.web.core.windows.net

401k 2024 Contribution Limit Chart, Thomson reuters tax & accounting. In 2022, the most you can contribute to a roth 401(k) and contribute in pretax contributions to a traditional 401(k) is $20,500.

Source: www.pelajaran.guru

Source: www.pelajaran.guru

401k Max 2023 Contribution Rules PELAJARAN, People 50 and over can contribute an extra $7,500 to their 401 (k) plan. Anyone age 50 or over is eligible for an additional.

Anyone Age 50 Or Over Is Eligible For An Additional.

The 401 (k) contribution limit is $23,000 in 2024.

Retirement Contribution Limits Are Adjusted Each Year For Inflation, And The Limits For Iras And 401 (K)S Are Different.

16, 2022, at 3:43 p.m.